By The Editorial Board

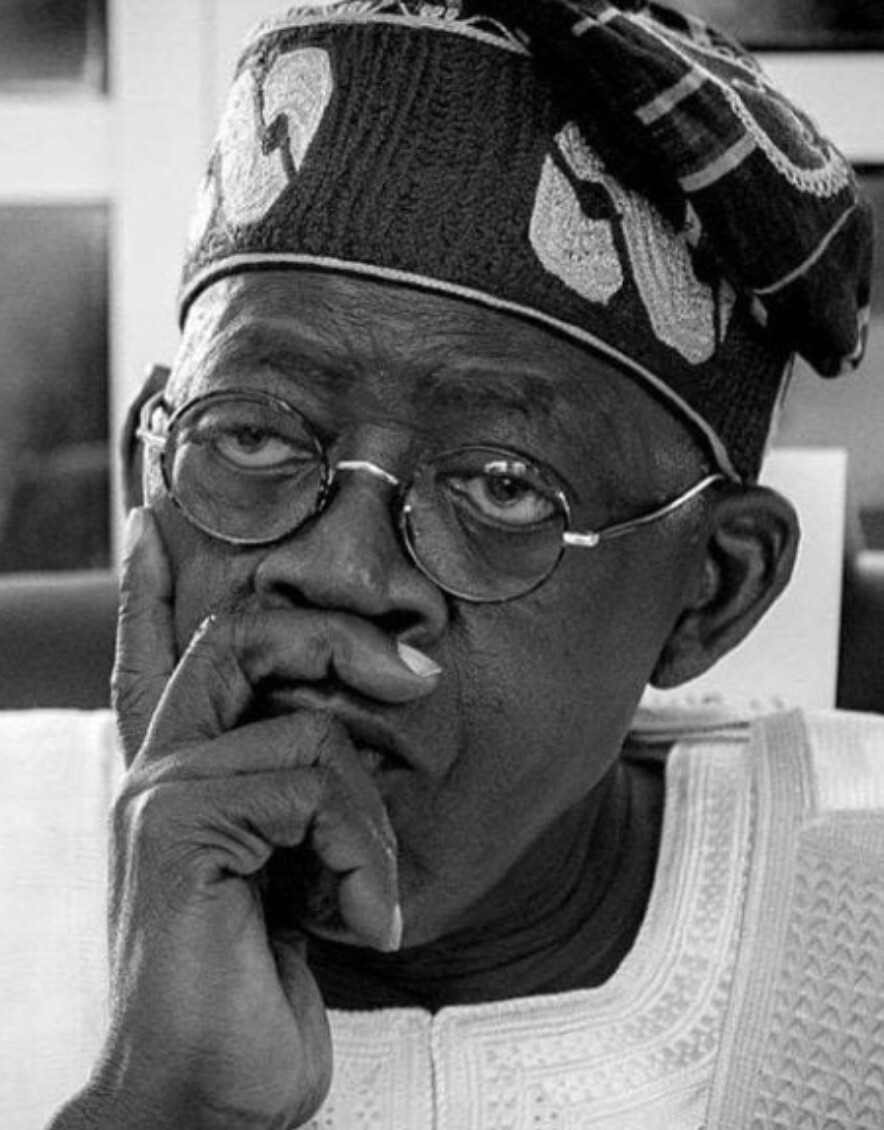

What was Mr. Tinubu thinking?

In a short span of just 50 days since taking office, Mr. Bola Tinubu has made two significant policy blunders that have raised questions about his ability to make well-thought-out and strategic policy choices, especially given Nigeria’s current economic challenges.

The consequences of his decisions have exacerbated the country’s economic problems rather than offer a viable solution.

Firstly, he hastily scrapped the fuel subsidy, and secondly, he opted to implement a floating Naira exchange rate. Simultaneously implementing these decisions is deeply troubling as they are imprudent, untimely and have severe adverse effects on the economy and the livelihood of long-suffering Nigerians.

When it comes to policy decision-making, it ought to involve rational evaluation, considering costs and benefits, priorities and timing, alternatives, and potential outcomes.

Unfortunately, Mr. Tinubu’s decision to introduce a floating exchange rate policy in the face of Nigeria’s overwhelming economic challenges raises apprehensions about his ability to make well-considered policy choices.

Criticism has been expressed in this journal regarding Mr. Tinubu’s removal of the fuel subsidy, which is seen as a self-serving move aimed at gaining international legitimacy. However, it is perceived as rash, untimely, and harmful to the well-being of the people.

Rather than eliminating the fuel subsidy, the sole benefit derived by ordinary Nigerians from the national oil dividend, the government should have focused on implementing a well-managed and corruption-free fuel subsidy program that uplifts the population without discarding the benefits.

The adoption of a floating exchange rate regime is another example of flawed economic policy-making that has exacerbated the country’s economic woes.

The continuous depreciation of the Naira has led to increased inflation (astronomically high costs of food, housing, transportation, medicine and fuel), hyper unemployment, and severe poverty rates, as well as higher costs for imported goods.

Given Nigeria’s current economic paralysis, diminishing oil demand, declining oil prices, substantial budget deficits, a soaring debt-to-GDP ratio, inadequate foreign currency reserves, and sluggish GDP growth, implementing a floating exchange rate policy appears to be ill-conceived and an ill-advised decision.

While floating the exchange rate has advantages, such as making exports cheaper and achieving a balance of payment equilibrium, these benefits are unlikely to materialize in Nigeria’s case, as it is not a production-based and export-oriented economy.

With minimal non-oil exports ($4.4Bn in 2022 out of a $477Bn economy), the impact of the policy on the economy would be limited.

The initial rationale provided by Mr. Tinubu and Obiora, the Deputy Governor of the Central Bank of Nigeria (CBN), that floating the Naira would increase foreign direct investment is unlikely to come to fruition.

The most significant risk associated with floating the exchange rate is its inherent volatility and speculative nature. The Naira becomes subject to unpredictable fluctuations within a single trading day, making investment decisions harder to predict, thus deterring foreign direct investment, and introducing uncertainty into trade.

Additionally, Nigeria still requires substantial foreign reserves to address the backlog of foreign currency demand for foreign companies, investors, and other obligations.

Providing the initial liquidity of over $12 billion (as estimated by experts) to facilitate foreign investors and companies repatriating their earnings would be a challenging task for the country.

Furthermore, floating the Naira without addressing crucial elements of economic policy, such as diversifying the economy away from oil reliance and adopting production-oriented strategies, as well as implementing strategic changes in trade policy, shows a flawed and myopic decision-making.

Considering these challenges, the Naira’s value may continue to erode, potentially surpassing the N1000/$1 mark very soon as predicted by speculators, with the black market rate becoming the de facto price-setting mechanism. As we write, today, the Naira was bought at N865/$1 and sold at N855/$1.

The Central Bank of Nigeria appears ill-prepared to respond promptly to currency speculators who possess superior skills and resources to exploit the country’s weak macroeconomic situation.

Mr. Obiora’s notion of a “dirty float” intervention, where the CBN’s hidden hands influence exchange rates, by manipulating supply and demand, seems unrealistic.

In fact, Mr. Obiora’s assertions are not accurate. In a floating exchange rate regime, exchange rate fluctuations are not solely determined by supply and demand.

Several crucial factors, such as Nigeria’s unfavorable economic and financial health (which is in a dire state), as well as negative market sentiment concerning Nigeria’s economic future (which is quite concerning), exert significant influence on the value of the Naira.

The demand for foreign currencies, particularly the dollar and euro, far exceeds the supply managed by the CBN. With diminishing foreign reserves, falling oil prices, limited export volume, and reduced remittances from Nigerians abroad, the CBN has no immediate means of remedying the fall of the Naira.

Given these circumstances, floating the Naira without addressing fundamental economic policy issues and reducing reliance on oil appears shortsighted.

The volatility and risks associated with this approach could have long-term repercussions on Nigeria’s economy and the well-being of its citizens unless counterbalancing policies are rapidly implemented.

Offering significant assistance to Nigerian families and workers during these challenging times is a commendable policy decision.

However, the proposed amount of N8,000 to only 12 million Nigerians is severely inadequate. Mr. Tinubu ought to contemplate a more substantial allocation to support the over 130 million Nigerians living in poverty.

However, to find a lasting solution, it is imperative to embrace a more comprehensive and strategic approach that addresses the root economic challenges and promote stability in both the Naira and the overall economic landscape.

It leaves us wondering if Mr. Tinubu is genuinely concerned about these matters.